Comparing QuickBooks Online and FreshBooks

Are ready to start your business?

Does the bookkeeping side cause you to pause?

Maybe you have already started and know you are a mess with your bookkeeping.

Every good business owner knows the importance of taking business finances seriously, but there are so many options of bookkeeping software, how do you choose?

You are in the right place to make sense of all this. To keep it simple, we are just going to compare the differences and the pros and cons between QuickBooks Online vs. FreshBooks.

If you would rather watch than read, check out THIS video. (There are also videos comparing Xero and Wave to Freshbooks)

This will be an honest comparison between the two softwares, but full disclosure, I am a FreshBooks Accounting Partner. I hope to gain your trust by truly showing the pros and cons of each software so you can make the best decision for your business.

Disclaimer: The links in the articles on this site may be affiliate links. This means I may receive compensation from vendors at no additional charge to you.

What to compare

To pick a bookkeeping software, you need to consider the following categories:

- Price

- Reports

- Integrations

- Support

- Time Tracking

- Payroll

- Payments and invoicing

- Accountant support

I will be discussing each of these in depth, highlighting what I think is important.

Price

These are the pages I used to compare the pricing between the two softwares:

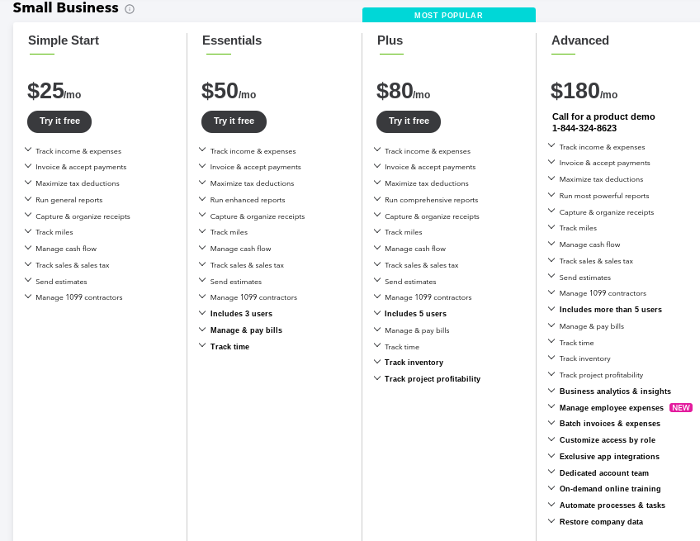

QuickBooks Price

Here is the QuickBooks pricing as of February 2022, please note that they usually increase their prices in the summer, after tax season.

Here are 2 ways to save money when purchasing QB:

- If you choose to skip the 3 month free trial, the prices decrease by half for the first 3 months.

- You can work with a bookkeeper to get a special wholesale pricing of 30% off. But if YOU start your QuickBooks account, you miss the chance to get the wholesale pricing. It is for NEW QuickBooks accounts. So, if you do decide that you need QuickBooks and want recommendations for great QuickBooks Bookkeepers, reach out to me. I know some great ones.

QuickBooks Plans (as of February 2022):

- Simple Start – $25/month

- Essentials – $50/month

- Plus – $80/month

- Advanced – $180/month

Sidenote, there is also a Self-Employed option – NEVER use this. You can’t upgrade to the other accounts, and there are easier ways to do your bookkeeping. Ask me – I can point you in the right direction. In my opinion, DON’T use this option.

The first 3 options will be the best choices for most small businesses. I have never known anyone to use Advanced. That is an extremely powerful software for large and complex companies.

Simple Start is the most basic and the tools and number of users increase with each tier.

I have a link to get QuickBooks for 55% off the first 3 months – click HERE* to check out this deal.

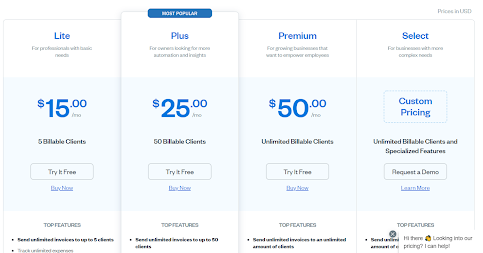

FreshBooks Price

Here is the FreshBooks pricing as of February 2022.

You are able to save 10% if you purchase a yearly package instead of paying monthly. If you use my accountant partner referral link, you can get your first 90 days free.*affiliate link

FreshBooks plans:

- Lite – $15/month

- Plus – $25/month

- Premium – $50/month

- Select – custom pricing

FreshBooks basic plan is $15 per month and the main limitation I see is the lack of inviting an accountant user or any other user for free (you can pay to add them) and the limit on only 5 billable clients. You can send unlimited ESTIMATES. That doesn’t count against your client limit in any plan.

Another important point is the difference between Plus and Premium. The biggest one is the unlimited clients on Premium vs 50 active clients on Plus. This distinction might be important for fast growing businesses or businesses that have a lot of smaller clients where maybe your engagements or services are for short periods of time.

If you do only a few high-dollar engagements for just a handful of clients each year the 50 client limit might not be a problem for you.

There are other things that distinguish FreshBooks Plus and Premium, notably the feature having to do with bill pay or the accounts payable functionality, but that part of FreshBooks still has a way to go before it becomes what they want it to be.

The ability to track project profitability reporting is a pretty cool feature that the Premium plan offers; if you have projects that are large enough to be standing alone where you want reports at the project level, you probably aren’t bumping up against that 50 active client limitation, but it might be a great feature for you to access or overall business strategy.

So, I’ll summarize by saying that as of now, though there are features that change with the different plans in FreshBooks, the most distinguishing feature is the number of clients that change with the plans. If you think you are going to be rapidly changing and acquiring clients, that might be something you don’t want to fiddle with.

The great thing is, if you choose to move up to the next plan, it is seamless.

It is important to think about your clients and your business goals – when thinking of those things, which software and plan seem like the best fit for you?

Reports

Both FreshBooks and QuickBooks will give you all the main accounting reports you need for your business. There are many reports to choose from, but let’s be honest, you will use a very small subset of the available reports. This is not where small business owners hang out, deep in the weeds of a bookkeeping software.

FreshBooks Reports

FreshBooks reports have all the standard accounting reports you will need, and you are able to tag your favorites, a feature I have found useful.

There are also project based reports to choose from with the Premium level. These reports are usable by the business owner to track a project and do it accurately. For example, an interior designer could track each project they worked throughout the year and see the success of each one.

FreshBooks also has a cash basis income statement but it does NOT have a cash basis balance sheet. I personally like to be able to generate both reports in the same accounting basis. It isn’t a deal breaker and it won’t affect any Schedule C tax filer because you don’t have to report a balance sheet. (I have given them feedback that I think it would help the reporting be more consistent).

QuickBooks Reports

QuickBooks has significantly more reports than FreshBooks, but as I have said, you most likely use the basic accounting reports. If you watch the video, I show you behind the scenes of the Report List. Even I as an accountant user who has spent a lot of time in QuickBooks find the list overwhelming when I see it.

One cool feature in QuickBooks is the Performance Center; it is a dashboard that shows you current graphs, charts, and accounts all in one place. Could be a little overwhelming, but you are able to customize to what you want to see.

QuickBooks Plus and above has project based tracking and profitability. These comprehensive reports allow location and class tracking, too. If you plan to use QuickBooks Plus for these features you will most likely either have a dedicated accounting employee or outsource this work.

You are also able to create customizable reports using different metrics and filters based on the needs of your business. And, once you have created this report, you are able to save it for future use. I have to hand it to QuickBooks – this is a powerful feature.

So, when comparing reports, both have the reporting features you will need. It is just a matter of what additional information you want to track, and are you going to outsource this job, or are you wanting to use a simpler version you can do yourself.

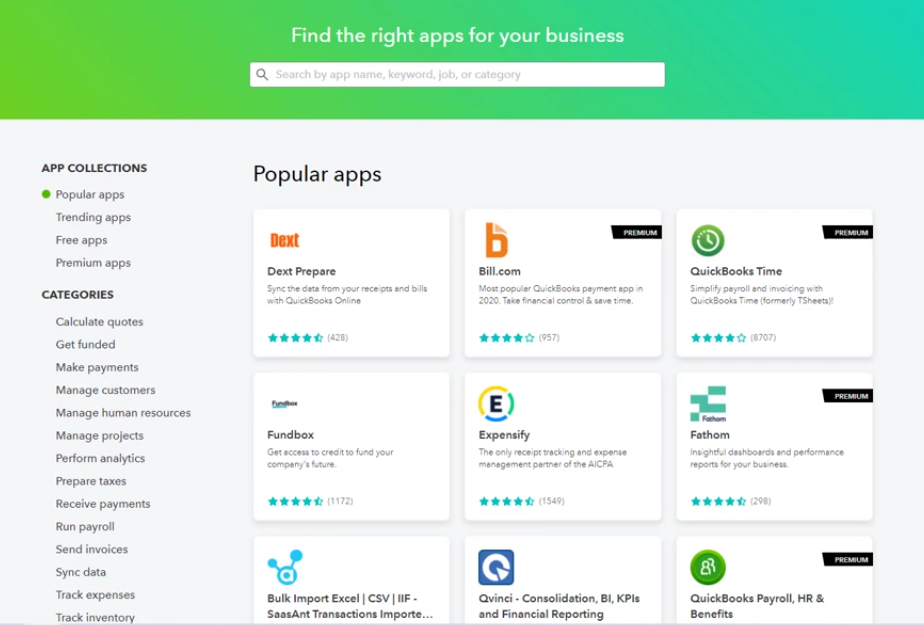

Integrations

In the entire global landscape of small business accounting software integrations, QuickBooks wins this category. Any time some software developer gets an idea about an accounting integration, the very first software they integrate with is QuickBooks becuase QuickBooks has the largest share of the global market.

So, you can’t fault the app developers for wanting to integrate with QuickBooks. Then all the Xero lovers say “Hey, when are you going to integrate with Xero?” and the developers say, “We’re in beta with our Xero integration! That’s next!”. And Xero rolls out a year later.

QuickBooks Integrations

When you want to integrate with QuickBooks, you have a gigantic library of options. Many of these are outstanding and when they are set up correctly they work very well and save businesses tons of time.

I would say it would be worth it to hire a really experienced QuickBooks ProAdvisor for an hour or two of their time to screen share with you to just take a peek behind the scenes to make sure you set up your integrations properly. It will be vastly more efficient than you spending days trying to learn how to do it and then troubleshooting your mistakes.

These integrations get rated by the users, too, so you can see their score. So that is really helpful.

FreshBooks Integrations

Regarding FreshBooks integrations, this area is a bit lacking and something they are building out, but, truthfully, FreshBooks is not even second on any app developer’s list of bookkeeping software to integrate with, so it will be slow going.

The ones that they do have are pretty good. They are proper accounting and finance integrations. I personally use Melio* and Gusto*.

Just remember – think back to your overall goals for your business. The QuickBooks integrations are impressive, but do you need them? Or will one or two great ones be enough for you?

Support

Customer support is important, especially when running your own business. If you need help, you want to be able to get help.

FreshBooks Support

Let’s start with the bright side of this topic. FreshBooks support is awesome! They have won awards for their support.

Freshboooks pours enormous resources into its support.

Every new employee, no matter what their job, has to work with support desk when they first start. You can talk on the phone, too. I’ve used that feature many times, so I can tell you it really is true. So, when you need help, you GET help.

Of ALL the accounting software, FreshBooks wins on support, not when only comparing them to QBO.

QuickBooks Support

QuickBooks Support, unfortunately, is a constant source of pain for QuickBooks users and accountant users.

Intuit knows this is a problem, and I have heard multiple times they are trying to solve it. I have no reason to doubt their efforts and I’ve noticed some improvements. They recently announced plans to bring accountant support back onshore in the US, but it is tough because it is not a low-skilled call center job. The support staff have to be real experts.

Honestly, I think the problem is that the software is so powerful and complex that it really is extremely tough to become proficient. Certainly no one who is hired in a low wage hourly support role is going to understand all the functions to properly use QuickBooks.

If you want to have success with QuickBooks Support, you kind of need to extract it from the rep yourself. If you sort of know what your problem is and can direct the support agent part of the way to your solution, there is a decent chance they can help you the last bit of the way, especially if it involves something on the technical side of the software that only Intuit could fix. But you have to lead the horse pretty close to the water. If you don’t know what to ask for, it can be really, really hard.

Time Tracking

Being able to track time within your bookkeeping software may be important to you, or maybe you will find other options that work for you. Let’s take a look at what QuickBooks and FreshBooks offer.

QuickBooks Time Tracking

QuickBooks doesn’t have a built-in time tracking option, but it does have several apps to choose from.

They bought a time tracking app called T-Sheet last year and now it is called QuickBooks Time. That will be marketed to you, but there is no timer – just timesheet manual entry.

There are others in the app store to choose from, but they all cost an additional fee. Some of these would be very complex time tracking tools.

FreshBooks Time Tracking

Basic time tracking is a native part of FreshBooks. Nothing fancy, just clocking in and out. It isn’t a robust tool like the ones that allow you to really manage a large shift based staff and make schedules for your employees and track at different sites and stuff. (To do that, you would use a different external app and then manually input your time data into Gusto to pay them).

If you want employees to track time and be able to seamlessly bill it to a client, FreshBooks has a fee of $10 per person per month to track time and assign it to projects. But, the good news is it is completely integrated instead of trying to involve a separate application which is what you’d have to do for QuickBooks.

Once again, think about your business goals – which of these sounds more reasonable to your business?

Payroll

So, time tracking naturally leads to payroll.

QuickBooks Payroll

QuickBooks has its own payroll that you access from their apps. It also has a countless amount of payroll apps that integrate with it. ADP and Paychex are what the big guys tend to use. Smaller upstarts use OnPay, Gusto and Patriot, but there are even more to choose from.

They all accomplish the same task of making sure people get paid.

FreshBooks Payroll

FreshBooks was smart. They realized it is best to partner with an American payroll expert than try to build their own payroll, so the way they approach payroll is to integrate with Gusto.

Gusto* happens to be my favorite payroll company and the one I use to run my own payroll. (sidenote: I was a Gusto fan even before I decided to become a FreshBooks bookkeeping expert).

Gusto and Intuit Integrated Payroll cost about the same. Gusto is $4 more per month total and does full service payroll in all 50 states and will file your 1099s for all contractors paid in Gusto.

As a Gusto user myself, I feel great offering my accountant referral link* to small businesses. If you sign up with Gusto using my small business link, you’ll get $100 giftcard after you run payroll 3 times. All the links to Gusto on this page are my accountant referral link.

Payments and Invoicing

We know it is important for you to get your payroll done, but it is JUST as important that you are able to get paid as well!

FreshBooks Payments and Invoicing

- 2.9% for credit cards

- 1% fee for ACH

QuickBooks Payments and Invoicing

You can set up QuickBooks Merchant services and get paid via credit card or ACH. You can also prohibit credit card payments and only accept ACH bank transfers if you want. That is a setting I use a lot.

A feature I like in QuickBooks payments is the ability to set up recurring payments once I get bank account ACH numbers from my clients. Once the invoice and automatic payment is setup, I get paid and the client doesn’t have to worry about it. Win-win for both parties.

Fees:

- 2.9% for credit cards

- 1% fee for ACH with a $10 max – (I am not aware of any other software that has a cap of the fee.)

Also, they have a business bank account called QuickBooks Cash where you can get ZERO ACH fees. I’ve not used this bank account and don’t have clients that use this. But, it is an option.

Both FreshBooks and QuickBooks have an additional feature where you can create a link to get paid.

This means you can create a link to put on a check-out page. When clicked, a client/customer can pay right away instead of creating an invoice. Lots of opportunities with that feature

Accountant Support

FInally, let’s take a look at the accountant support you get with each bookkeeping software.

QuickBooks Accountant Support

So, we’ll start with QuickBooks. They have an army of certified pros called ProAdvisors. And by army, I mean a gagillion.

You can go to the Find a ProAdvisor directory and search by your zip code HERE. You should not have trouble finding many, many people to interview to help you with your QuickBooks. Your problem may be whittling it down.

Needless to say, there is plenty of accountant support within QuickBooks.

When you search my zip code, I’m ranked number 3. That means I’m pretty darn good at small business accounting.

FreshBooks Accountant Support

In the last 2 years, FreshBooks has hired a full-blown staff at headquarters dedicated to building and growing their partnership with accountants.

I’m one of the first people to become certified in FreshBooks on their version 1 of their training for accountants. And they are now on version 2 of their training and it is even more robust. They have a proper certification program that accountants go through to earn the title FreshBooks Accounting Partner. (FYI, I’m one of those certified FreshBooks accounting partners)

They have a directory that you can access and they are prioritizing making it even better, but it is sufficient and will get you a list of several certified pros to interview. Check out THIS VIDEO for tips on finding the best FreshBooks Accounting Pro for your needs.

All this to say, there are going to be more and more accountants and bookkeepers getting the training they need to start helping small businesses with their FreshBooks files.

Overall Thoughts

Well, we’ve looked at quite a bit about QuickBooks and FreshBooks. Hopefully this comparison will help you choose the best accounting software to fit your needs.

Be sure to check out the other comparisons I’ve done:

If you have any questions, comment below or email me at Kate@heritagebusinessservices.com

If you are READY, you can try the premium version of FreshBooks completely free for 90 days with my link HERE*.

And if you are interested in ongoing support, please don’t hesitate to reach out. I can do your bookkeeping for you if you are ready to outsource.

Or you might be a good candidate for my Fresh Bookkeeping network where I provide weekly office hours to businesses who are doing their bookkeeping on Freshbooks themselves but need a little bit of support and guidance and accountability.

I’m Kate Josephine Johnson, owner of Heritage Business Services and help business owners build their business legacy.